News Release

U.S. International Transactions, 3rd Quarter 2022

Current-Account Deficit Narrows by 9.1 Percent

Current-Account Balance

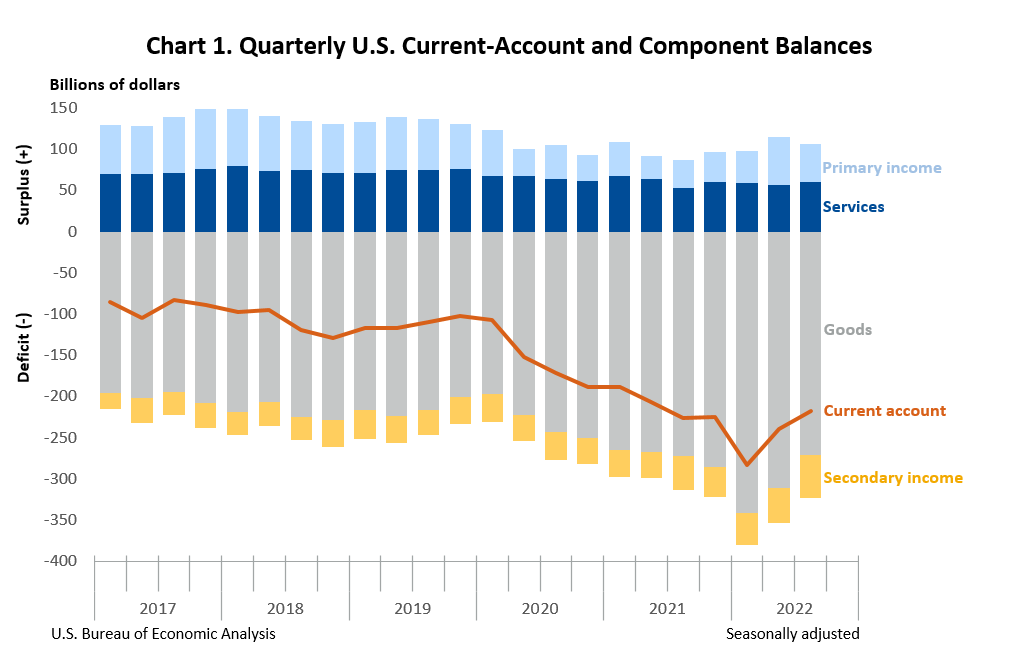

The U.S. current-account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, narrowed by $21.6 billion, or 9.1 percent, to $217.1 billion in the third quarter of 2022, according to statistics released today by the U.S. Bureau of Economic Analysis. The revised second-quarter deficit was $238.7 billion.

The third-quarter deficit was 3.4 percent of current-dollar gross domestic product, down from 3.8 percent in the second quarter.

The $21.6 billion narrowing of the current-account deficit in the third quarter mostly reflected a decreased deficit on goods that was partly offset by a decreased surplus on primary income and an increased deficit on secondary income.

Current-Account Transactions (tables 1–5)

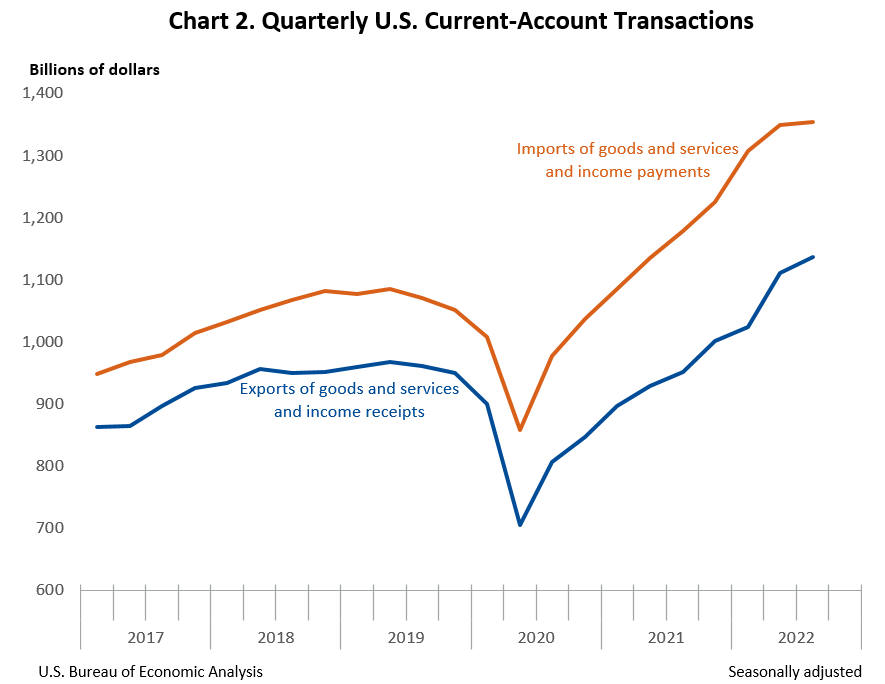

Exports of goods and services to, and income received from, foreign residents increased $26.5 billion to $1.14 trillion in the third quarter. Imports of goods and services from, and income paid to, foreign residents increased $4.8 billion to $1.35 trillion.

Trade in goods (table 2)

Exports of goods increased $7.2 billion to $547.0 billion, reflecting increases in nonmonetary gold and in capital goods, mostly civilian aircraft engines and parts and other industrial machinery, that were partly offset by a decrease in foods, feeds, and beverages, mostly soybeans and corn. Imports of goods decreased $32.5 billion to $818.2 billion, reflecting widespread decreases in consumer goods and in industrial supplies and materials. The decrease in consumer goods was led by household and kitchen appliances and other household goods, and the decrease in industrial supplies and materials was led by metals and nonmetallic products.

Trade in services (table 3)

Exports of services increased $4.9 billion to $234.0 billion, reflecting increases in other business services, mainly professional and management consulting services, and in travel, mostly education-related travel and other personal travel. Imports of services increased $1.6 billion to $173.5 billion, reflecting increases in travel, mostly other personal travel and education-related travel, and in financial services, mostly financial intermediation services indirectly measured and financial management services, that were partly offset by a decrease in transport, mostly sea freight transport.

Primary income (table 4)

Receipts of primary income increased $15.2 billion to $314.0 billion, and payments of primary income increased $26.8 billion to $268.4 billion. The increases in both receipts and payments primarily reflected increases in other investment income, mostly interest on loans and deposits. These increases were mainly due to higher short-term interest rates that resulted from significant federal funds rate hikes by the Federal Reserve Board in May, June, July, and September. U.S. other investment assets and liabilities are mainly denominated in U.S. dollars.

Secondary income (table 5)

Receipts of secondary income decreased $0.8 billion to $42.7 billion, reflecting a decrease in general government transfers, mostly fines and penalties. Payments of secondary income increased $9.0 billion to $94.9 billion, reflecting an increase in general government transfers, mostly international cooperation.

Capital-Account Transactions (table 1)

Capital-transfer receipts were $9.1 billion in the third quarter. The transactions reflected receipts from foreign insurance companies for losses resulting from Hurricane Ian. For information on transactions associated with hurricanes and other disasters, see “How do losses recovered from foreign insurance companies following natural or man-made disasters affect foreign transactions, the current account balance, and net lending or net borrowing?”.

Financial-Account Transactions (tables 1, 6, 7, and 8)

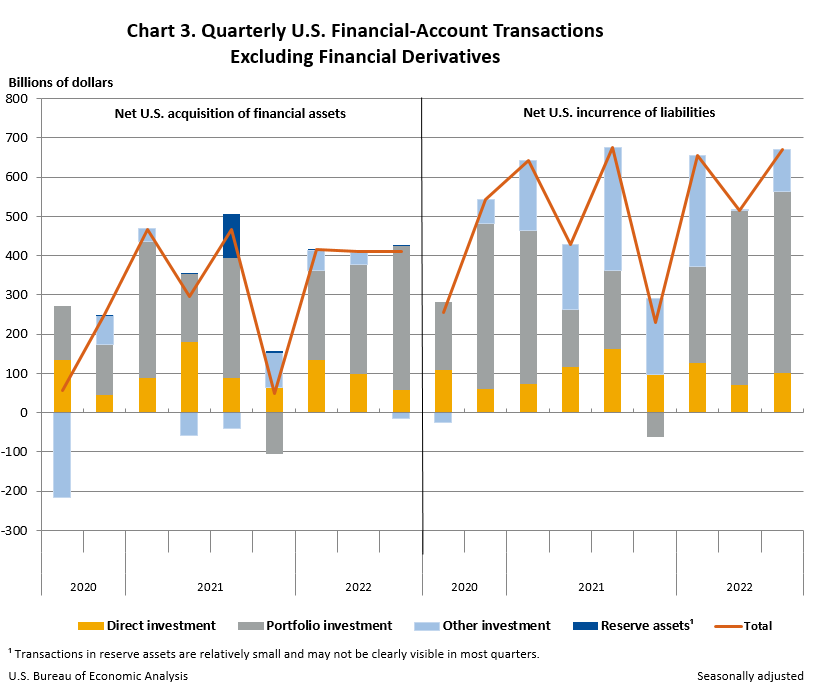

Net financial-account transactions were −$294.2 billion in the third quarter, reflecting net U.S. borrowing from foreign residents.

Financial assets (tables 1, 6, 7, and 8)

Third-quarter transactions increased U.S. residents’ foreign financial assets by $411.0 billion. Transactions increased portfolio investment assets, mostly equity and long-term debt securities, by $368.9 billion; direct investment assets, mainly equity, by $56.7 billion; and reserve assets by $0.8 billion. Transactions decreased other investment assets by $15.5 billion, resulting from partly offsetting transactions in loans and deposits.

Liabilities (tables 1, 6, 7, and 8)

Third-quarter transactions increased U.S. liabilities to foreign residents by $671.2 billion. Transactions increased portfolio investment liabilities, mostly long-term debt securities and equity, by $463.2 billion; other investment liabilities, mostly loans, by $106.6 billion; and direct investment liabilities, mostly equity, by $101.4 billion.

Financial derivatives (table 1)

Net transactions in financial derivatives were –$33.9 billion in the third quarter, reflecting net U.S. borrowing from foreign residents.

|

Table A. Updates to Second-Quarter 2022 International Transactions Accounts Balances [Billions of dollars, seasonally adjusted] |

||

| Preliminary estimates | Revised estimates | |

|---|---|---|

| Current-account balance | –251.1 | −238.7 |

| Goods balance | −310.5 | −310.9 |

| Services balance | 57.1 | 57.3 |

| Primary income balance | 43.6 | 57.2 |

| Secondary income balance | −41.3 | −42.3 |

| Net financial-account transactions | −159.5 | −152.2 |

| U.S. Bureau of Economic Analysis | ||

Next release: March 23, 2023, at 8:30 a.m. EDT

U.S. International Transactions, 4th Quarter and Year 2022

| U.S. International Transactions Release Dates in 2023 | |

|---|---|

| 4th Quarter and Year 2022 | March 23 |

| 1st Quarter 2023 and Annual Update | June 22 |

| 2nd Quarter 2023 | September 21 |

| 3rd Quarter 2023 | December 20 |