News Release

U.S. International Transactions, Second Quarter 2021

Current Account Balance, Second Quarter

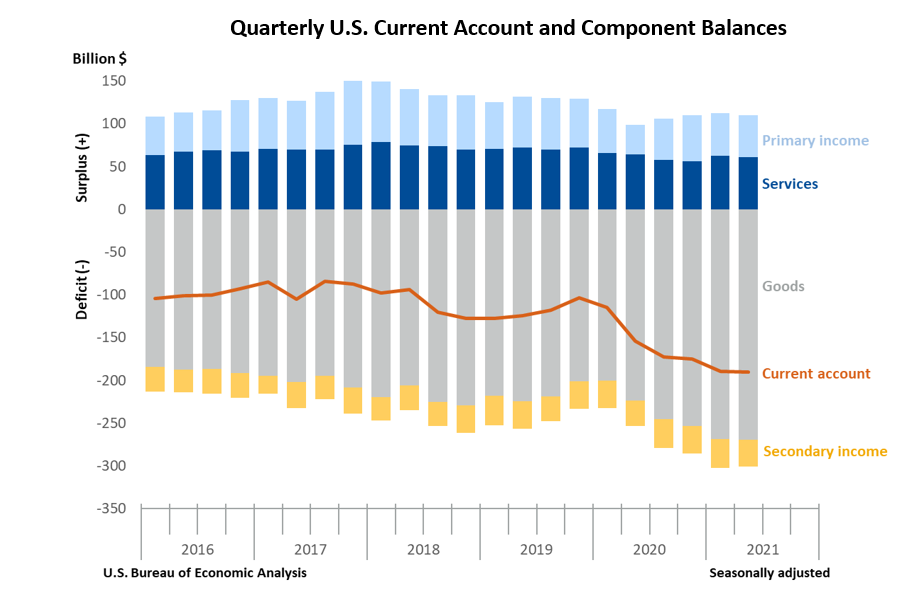

The U.S. current account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, widened by $0.9 billion, or 0.5 percent, to $190.3 billion in the second quarter of 2021, according to statistics from the U.S. Bureau of Economic Analysis (BEA). The revised first quarter deficit was $189.4 billion.

The second quarter deficit was 3.3 percent of current dollar gross domestic product, down from 3.4 percent in the first quarter.

The $0.9 billion widening of the current account deficit in the second quarter mainly reflected reduced surpluses on services and on primary income that were mostly offset by a reduced deficit on secondary income.

Current Account Transactions (tables 1-5)

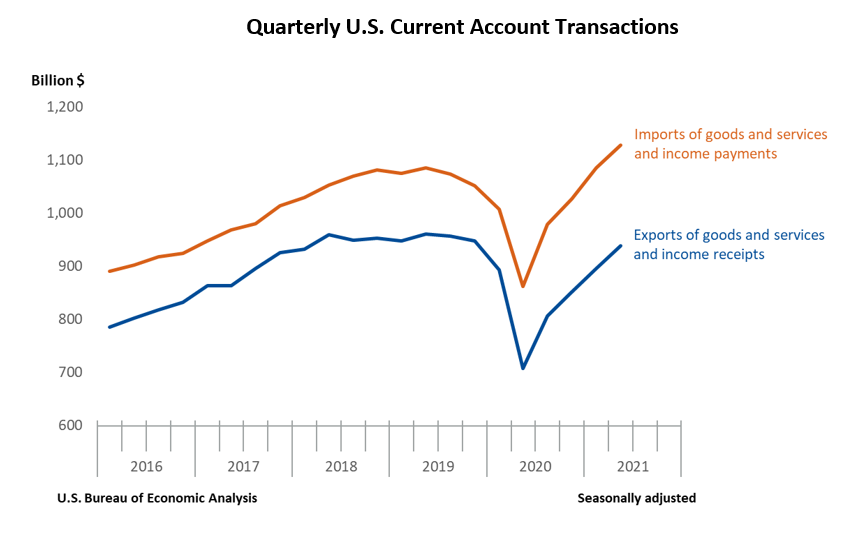

Exports of goods and services to, and income received from, foreign residents increased $42.7 billion, to $937.9 billion, in the second quarter. Imports of goods and services from, and income paid to, foreign residents increased $43.6 billion, to $1.13 trillion.

Trade in Goods (table 2)

Exports of goods increased $28.3 billion, to $436.6 billion, mostly reflecting increases in industrial supplies and materials, mainly petroleum and products, and in capital goods, mainly civilian aircraft and semiconductors. Imports of goods increased $29.0 billion, to $706.3 billion, primarily reflecting an increase in industrial supplies and materials, mainly petroleum and products and metals and nonmetallic products.

Trade in Services (table 3)

Exports of services increased $7.6 billion, to $189.1 billion, primarily reflecting an increase in travel, mostly other personal travel. Imports of services increased $9.1 billion, to $127.8 billion, mostly reflecting increases in transport, primarily sea freight and air passenger transport, and in travel, primarily other personal travel.

Primary Income (table 4)

Receipts of primary income increased $7.7 billion, to $270.6 billion, and payments of primary income increased $8.8 billion, to $221.5 billion. The increases in both receipts and payments mainly reflected increases in direct investment income, primarily earnings.

Secondary Income (table 5)

Receipts of secondary income decreased $0.9 billion, to $41.6 billion, mainly reflecting a decrease in general government transfers, mostly public sector fines and penalties. Payments of secondary income decreased $3.5 billion, to $72.6 billion, mainly reflecting a decrease in general government transfers, mostly international cooperation.

Capital Account Transactions (table 1)

Capital transfer payments decreased $1.9 billion, to $0.9 billion, in the second quarter, mostly reflecting a decrease in investment grants.

Financial Account Transactions (tables 1, 6, 7, and 8)

Net financial account transactions were −$287.3 billion in the second quarter, reflecting net U.S. borrowing from foreign residents.

Financial Assets (tables 1, 6, 7, and 8)

Second quarter transactions increased U.S. residents’ foreign financial assets by $248.2 billion. Transactions increased direct investment assets, primarily equity, by $139.7 billion; portfolio investment assets, primarily equity securities, by $134.8 billion; and reserve assets by $0.5 billion. Transactions decreased other investment assets by $26.7 billion, driven by deposits.

Liabilities (tables 1, 6, 7, and 8)

Second quarter transactions increased U.S. liabilities to foreign residents by $527.0 billion. Transactions increased portfolio investment liabilities, primarily long-term debt securities, by $236.6 billion; other investment liabilities, mostly loans and deposits, by $195.4 billion; and direct investment liabilities, mostly equity, by $95.0 billion.

Financial Derivatives (table 1)

Net transactions in financial derivatives were −$8.6 billion in the second quarter, reflecting net U.S. borrowing from foreign residents.

|

Updates to First Quarter 2021 International Transactions Accounts Balances Billions of dollars, seasonally adjusted |

||

| Preliminary estimate | Revised estimate | |

|---|---|---|

| Current account balance | −195.7 | −189.4 |

| Goods balance | −268.5 | −268.9 |

| Services balance | 55.7 | 62.8 |

| Primary income balance | 50.3 | 50.2 |

| Secondary income balance | −33.3 | −33.5 |

| Net financial account transactions | −175.2 | −180.8 |

Upcoming Releases of New Statistics

With the releases of the U.S. international transactions accounts (ITAs) on December 21, 2021, and the international investment position (IIP) accounts on December 30, 2021, BEA will introduce two new ITA tables (ITA tables 4.6 and 6.3) and two new IIP tables (IIP tables 2.2 and 4.1), respectively. These new tables will be released in December to fulfill commitments to the G-20 Data Gaps Initiative and the International Monetary Fund’s Taskforce on Special Purpose Entities for the release of certain new statistics by yearend 2021. ITA table 4.6 will present primary income on foreign direct investment in U.S. resident special purpose entities (SPEs), which are U.S. legal entities with little or no employment or physical presence, and ITA table 6.3 will present financial transactions for direct investment in U.S. resident SPEs. IIP table 2.2 will present direct investment positions in U.S. resident SPEs, and IIP table 4.1 will present U.S. debt positions by currency, sector, and maturity for U.S. assets and liabilities.

In December, these tables will be released as supplemental Excel files to the respective releases. The SPE-related tables—ITA tables 4.6 and 6.3 and IIP table 2.2—will feature annual statistics for 2020, while IIP table 4.1 will feature quarter-end position statistics for the first quarter of 2020 through the third quarter of 2021. In March 2022, these tables will be updated and published as addenda to the current tables in BEA’s interactive data application. In June 2022, the statistics will be updated and incorporated into the standard presentations of the ITAs and the IIP accounts in the interactive data application and in BEA’s data application programming interface. ITA table templates and IIP table templates are provided with this release to prepare users for the upcoming changes. More information will be available in a preview article of BEA’s annual update of the international economic accounts in the April 2022 issue of the Survey of Current Business.

* * *

Next release: December 21, 2021 at 8:30 A.M. EST

U.S. International Transactions, Third Quarter 2021

* * *