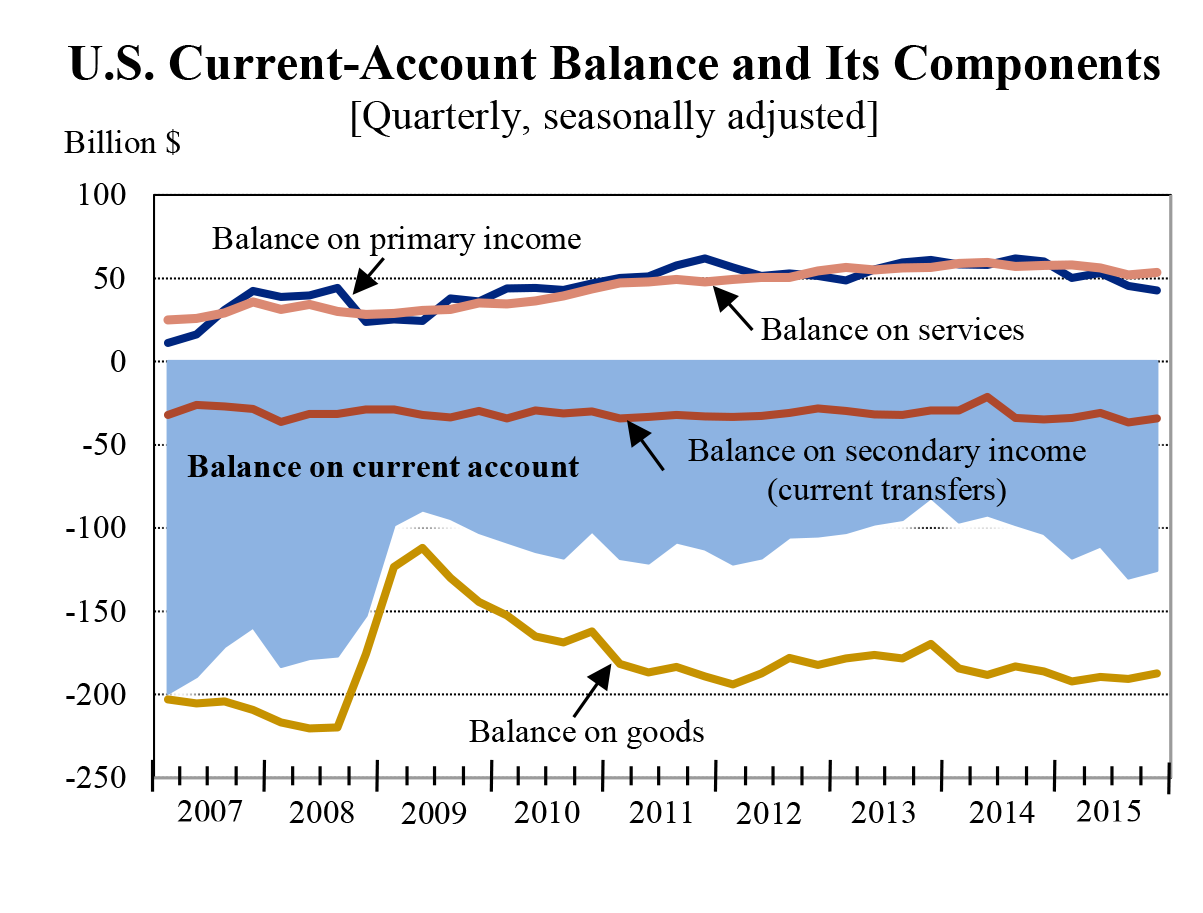

The U.S. current-account deficit—a net measure of transactions between the United States and the rest of the world in goods, services, primary income (investment income and compensation), and secondary income (current transfers)—decreased to $125.3 billion (preliminary) in the fourth quarter of 2015 from $129.9 billion (revised) in the third quarter of 2015. As a percentage of U.S. GDP, the deficit decreased to 2.8 percent from 2.9 percent. The previously published current-account deficit for the third quarter was $124.1 billion.

- The deficit on international trade in goods decreased to $187.3 billion from $190.5 billion as goods imports decreased more than goods exports.

- The surplus on international trade in services increased to $53.5 billion from $51.9 billion as services exports increased more than services imports.

- The surplus on primary income decreased to $42.8 billion from $45.4 billion as primary income receipts decreased more than primary income payments.

- The deficit on secondary income (current transfers) decreased to $34.3 billion from $36.7 billion as secondary income payments decreased and secondary income receipts increased.

Net U.S. borrowing from financial-account transactions was $29.4 billion in the fourth quarter, down from $59.5 billion in the third.

- Net U.S. sales of financial assets excluding financial derivatives was $126.1 billion in the fourth quarter, up from $95.9 billion in the third.

- Net U.S. repayment of liabilities excluding financial derivatives was $84.4 billion in the fourth quarter, up from $35.7 billion in the third.

- Net lending in financial derivatives other than reserves was $12.3 billion in the fourth quarter, up from $0.7 billion in the third.

For more information, read the full report.