News Release

Direct Investment by Country and Industry, 2019

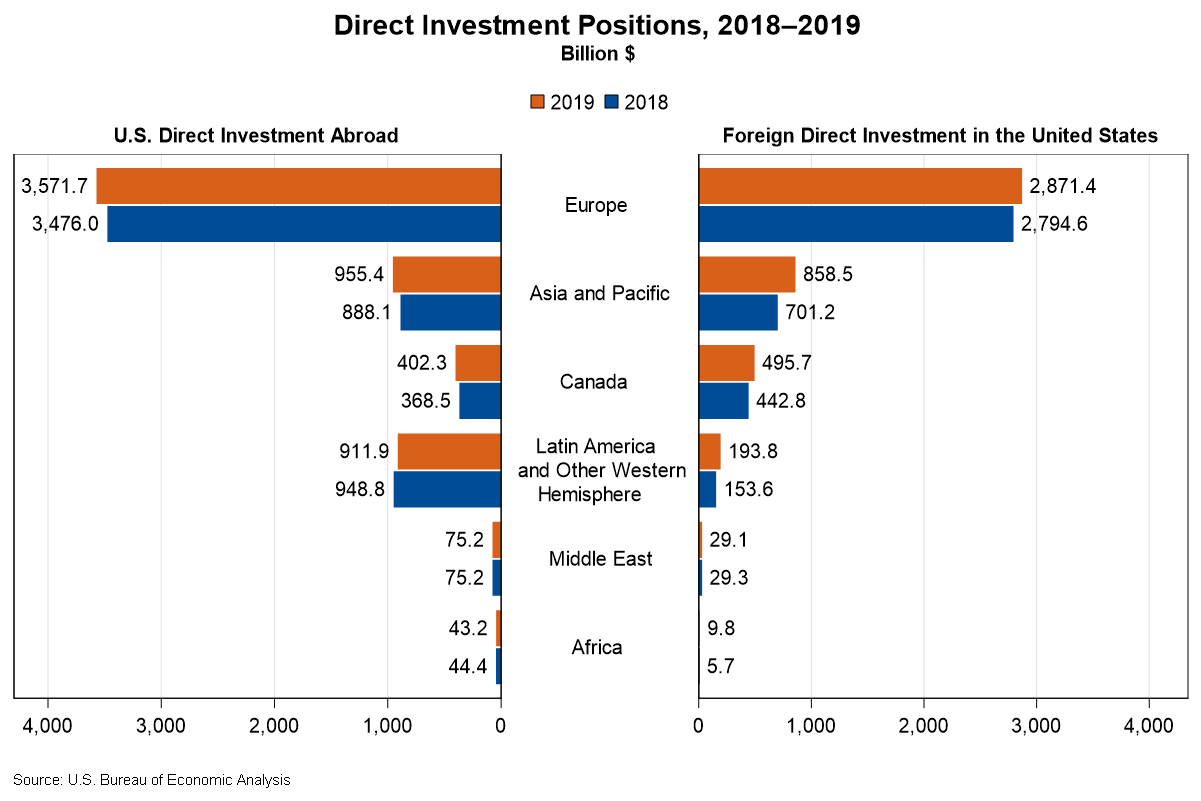

The U.S. direct investment abroad position, or cumulative level of investment, increased $158.6 billion to $5.96 trillion at the end of 2019 from $5.80 trillion at the end of 2018, according to statistics released by the Bureau of Economic Analysis (BEA). The increase reflected a $95.7 billion increase in the position in Europe, primarily in the United Kingdom and the Netherlands. By industry, manufacturing affiliates accounted for most of the increase.

The foreign direct investment in the United States position increased $331.2 billion to $4.46 trillion at the end of 2019 from $4.13 trillion at the end of 2018. The increase mainly reflected a $157.3 billion increase in the position from Asia and Pacific, primarily Japan. By industry, affiliates in manufacturing, finance and insurance, and wholesale trade accounted for the largest increases.

Continued Impact of the 2017 Tax Cuts and Jobs Act (TCJA) on U.S. Direct Investment Abroad

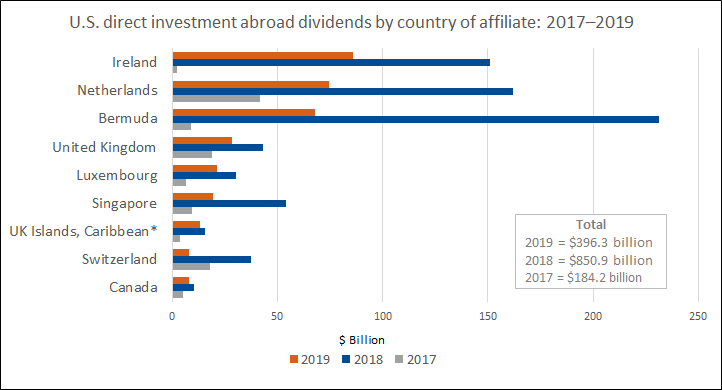

The TCJA generally eliminated taxes on dividends, or repatriated earnings, to U.S. multinationals from their foreign affiliates. In 2019, dividends decreased $454.5 billion to $396.3 billion from $850.9 billion in 2018, but were still more than twice the average annual dividends from the 10 years prior to the TCJA. By country, more than half of the dividends in 2019 were repatriated from affiliates in three countries: Ireland ($85.8 billion), the Netherlands ($74.3 billion), and Bermuda ($67.9 billion) (table 3). By industry, U.S. multinationals in chemical manufacturing ($99.6 billion) and computers and electronic products manufacturing ($92.5 billion) repatriated nearly half of all dividends in 2019 (table 4).

U.S. direct investment abroad (tables 1 – 6)

U.S. multinational enterprises (MNEs) invest in nearly every country, but their investment in affiliates in five countries accounted for more than half of the total position at the end of 2019. The U.S. direct investment abroad position remained the largest in the Netherlands at $860.5 billion, followed by the United Kingdom ($851.4 billion) and Luxembourg ($766.1 billion). Canada ($402.3 billion) moved up one position from 2018 to be the fourth largest host economy, moving Ireland ($354.9 billion) into fifth.

By industry of the directly-owned foreign affiliate, investment was highly concentrated in holding companies, which accounted for nearly half of the overall position in 2019. Most holding company affiliates, which are owned by U.S. parents from a variety of industries, own other foreign affiliates that operate in a variety of industries. By industry of the U.S. parent, investment by manufacturing MNEs accounted for 51.9 percent of the position, followed by MNEs in finance and insurance (12.8 percent).

U.S. MNEs earned income of $532.7 billion in 2019 on their cumulative investment abroad, a 2.1 percent decrease from 2018.

Foreign direct investment in the United States (tables 7 – 10)

By country of the foreign parent, five countries accounted for more than half of the total position at the end of 2019. Japan moved up one position from 2018 to be the top investing country in 2019 with a position of $619.3 billion, moving the United Kingdom ($505.1 billion) to second. Canada ($495.7 billion) and Netherlands ($487.1 billion) switched places as the third and fourth largest investing countries. Germany ($372.9 billion) remained the fifth largest investing country at the end of 2019.

By country of the ultimate beneficial owner (UBO), the top five countries in terms of position were Japan ($644.7 billion), Canada ($580.8 billion), Germany ($522.0 billion), the United Kingdom ($446.2 billion), and Ireland ($343.5 billion). On the UBO basis, investment from the Netherlands and Luxembourg was much lower than by country of foreign parent, indicating that much of the investment from foreign parents in these countries was ultimately owned by investors in other countries.

Foreign direct investment in the United States was concentrated in the U.S. manufacturing sector, which accounted for 40.1 percent of the position. There was also sizable investment in finance and insurance (12.3 percent) and wholesale trade (10.5 percent).

Foreign MNEs earned income of $208.1 billion in 2019 on their cumulative investment in the United States, a 0.8 percent increase from 2018.

Updates to Direct Investment Statistics

BEA statistics for U.S. direct investment abroad and foreign direct investment in the United States for 2016–2018 are revised to incorporate newly available and revised source data.

Next release: July 2021

Direct Investment by Country and Industry, 2020