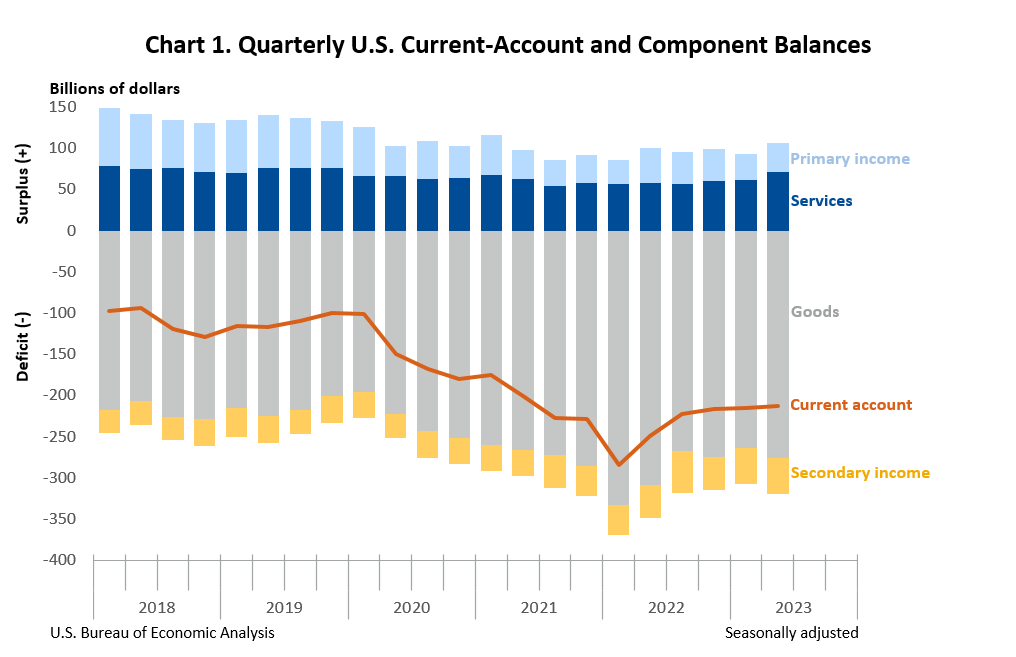

The U.S. current-account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, narrowed by $2.4 billion, or 1.1 percent, to $212.1 billion in the second quarter of 2023. The narrowing primarily reflected expanded surpluses on services and on primary income that were mostly offset by an expanded deficit on goods. The second-quarter deficit was 3.2 percent of current-dollar gross domestic product, down less than 0.1 percent from the first quarter.

- Exports of goods decreased $29.0 billion to $497.6 billion, while imports of goods decreased $17.1 billion to $772.8 billion.

- Exports of services increased $4.7 billion to $247.3 billion, while imports of services decreased $5.5 billion to $175.7 billion.

- Receipts of primary income increased $15.5 billion to $354.5 billion, while payments of primary income increased $12.0 billion to $319.5 billion.

- Receipts of secondary income increased $1.0 billion to $45.9 billion, while payments of secondary income increased $0.4 billion to $89.5 billion.

- Net financial-account transactions were −$109.0 billion in the second quarter, reflecting net U.S. borrowing from foreign residents.

With this release, BEA has incorporated newly available source data from the Treasury International Capital System “Aggregate Holdings, Purchases and Sales, and Fair Value Changes of Long-Term Securities by U.S. and Foreign Residents” form to more accurately measure transactions in equity and investment fund shares and in long-term debt securities, which are components of the portfolio investment category in the financial account. See the “Technical Note” for more information.

For more information, read the full release.