Real gross domestic product (GDP) decreased at an annual rate of 1.6 percent in the first quarter of 2022, following an increase of 6.9 percent in the fourth quarter of 2021. The decrease was revised down 0.1 percentage point from the “second” estimate released in May. In the first quarter, there was a resurgence of COVID-19 cases from the Omicron variant and decreases in government pandemic assistance payments. For more details, including source data, see the Technical Note and Federal Recovery Programs and BEA Statistics.

GDP highlights

The first quarter decrease in real GDP reflected decreases in exports, federal government spending, inventory investment, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Business investment and consumer spending increased.

- The decrease in exports reflected a decrease in goods (led by nondurable goods) that was partly offset by an increase in services (led by government goods and services).

- The decrease in federal government spending primarily reflected a decrease in consumption expenditures (led by intermediate goods and services) and defense spending on investment (led by defense equipment).

- The decrease in inventory investment primarily reflected decreases in wholesale trade (led by motor vehicles) as well as the category of mining, utilities, and construction (notably, utilities).

- The increase in imports primarily reflected an increase in goods (led by durable goods).

- The increase in business investment reflected increases in equipment (led by information processing equipment) and intellectual property products (led by software).

- The increase in consumer spending reflected an increase in services (led by housing and utilities and “other” services).

Updates to GDP

The update primarily reflects a downward revision to consumer spending that was partly offset by an upward revision to inventory investment.

Personal income and saving

Real disposable personal income (DPI)— personal income adjusted for taxes and inflation—decreased7.8 percent (revised) in the first quarter after decreasing 4.5 percent in the fourth quarter of 2021.

The decrease in current-dollar DPI primarily reflected an increase in personal current taxes and a decrease in government social benefits that were partly offset by an increase in compensation. Personal saving as a percentage of DPI was 5.6 percent (revised) in the first quarter, compared with 7.9 percent in the fourth quarter of 2021.

Corporate profits from current production

Profits decreased 2.2 percent (revised) in the first quarter, after increasing 0.7 percent at a quarterly rate in the fourth quarter.

- Profits of domestic nonfinancial corporations decreased 0.3 percent (revised) after increasing 0.3 percent.

- Profits of domestic financial corporations decreased 9.3 percent (revised) after decreasing 0.2 percent.

- Profits from the rest of the world decreased 1.5 percent (revised) after increasing 3.3 percent.

Corporate profits increased 12.6 percent (revised) in the first quarter from one year ago.

Prices

Prices of goods and services purchased by U.S. residents, the gross domestic purchases price index, increased 8.0 percent (revised) in the first quarter after increasing 7.0 percent in the fourth quarter. Energy prices increased 43.2 percent (revised) and food prices increased 11.2 percent (revised) in the first quarter. Excluding food and energy, prices increased 6.9 percent (revised) in the first quarter after increasing 6.2 percent in the fourth quarter.

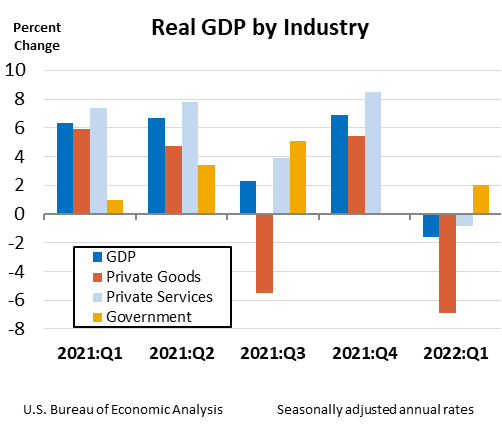

Gross domestic product by industry

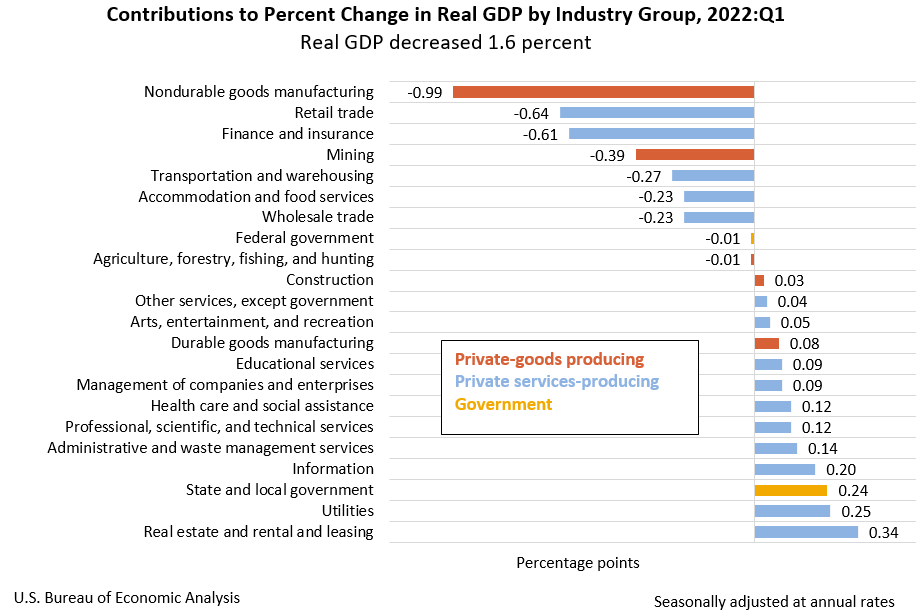

Today’s release includes estimates of GDP by industry, or value added—a measure of an industry’s contribution to GDP. Private goods-producing industries decreased6.9 percent, private services producing industries decreased0.8 percent, and government increased 2.0 percent. Overall, 9 of 22 industry groups contributed to the first-quarter decline in real GDP.

- The decrease in private goods-producing industries primarily reflected a decrease in nondurable goods manufacturing (led by petroleum and coal products) and mining.

- The decrease in private services-producing industries primarily reflected decreases in retail trade as well as finance and insurance. These decreases were partly offset by an increase in real estate and rental and leasing.

- The increase in government reflected an increase in state and local government that was partly offset by a decrease in federal government.

For more information, read the full release.