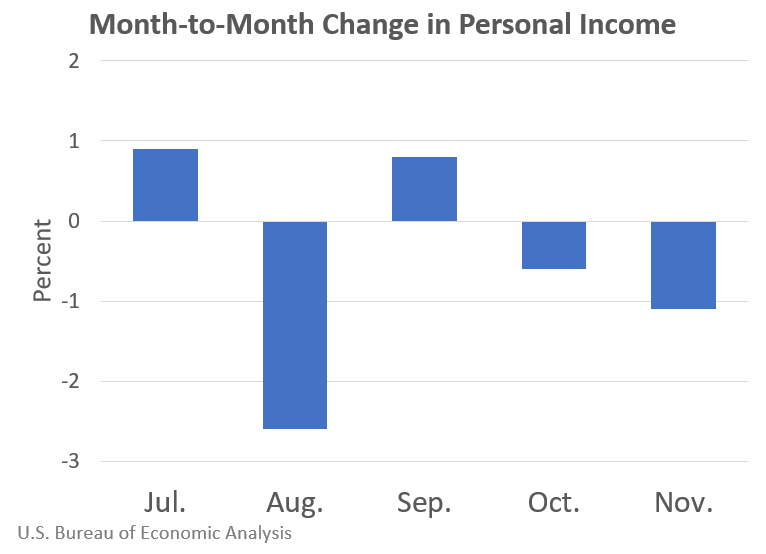

Personal income decreased 1.1 percent while consumer spending decreased 0.4 percent in November as federal economic recovery payments and pandemic-related assistance programs continued to wind down.

Personal income

The decrease in personal income in November reflected decreases in proprietors’ income and government social benefits. Within nonfarm proprietors’ income, the decline reflected a decrease in Paycheck Protection Program loans to businesses. Within farm proprietors’ income, the decline reflected a decrease in payments for the Coronavirus Food Assistance Program as well as a decrease in Paycheck Protection Program loans to businesses. Within government social benefits, “other” social benefits decreased reflecting a decline in Lost Wages Supplemental Payments, a Federal Emergency Management Agency program that provides wage assistance to individuals impacted by the pandemic. Additional information on factors affecting monthly personal income can be found on “Effects of Selected Federal Pandemic Response Programs on Personal Income”.

Consumer spending

Current dollar consumer spending decreased in November, reflecting decreases in goods and services.

- Within goods, durable goods (led by motor vehicles and parts) and nondurable goods (led by clothing and footwear) contributed to the decrease. Spending for motor vehicles and parts was based on unit sales data from Ward’s while spending for clothing and footwear was based on Census Monthly Retail Trade Survey (MRTS) data.

- Within services, the largest contributors to the decrease were food services and accommodations (led by food services) as well as household utilities. Spending for food services was based on Census MRTS data while spending for household utilities was based on Energy Information Administration projections for electricity and natural gas usage.

For more information, read the full release.