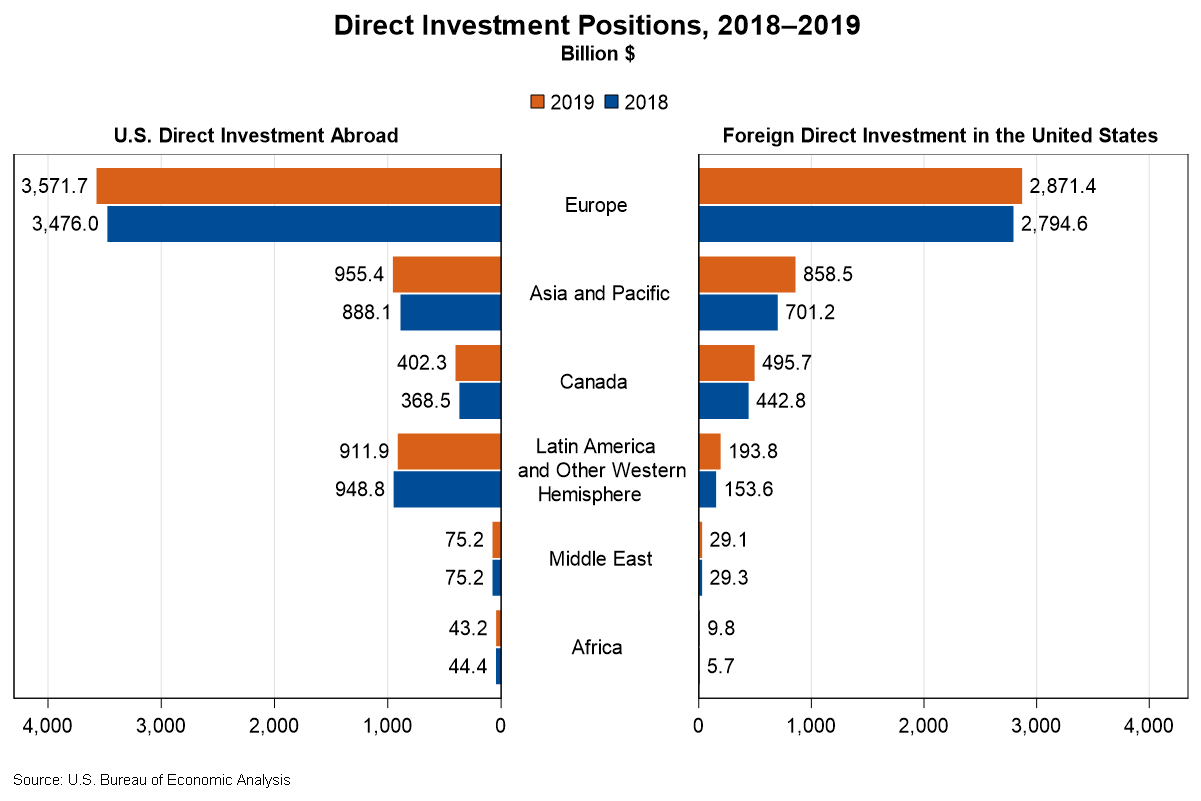

The U.S. direct investment abroad position, or cumulative level of investment, increased $158.6 billion to $5.96 trillion at the end of 2019 from $5.80 trillion at the end of 2018, according to statistics released by the Bureau of Economic Analysis (BEA). The increase reflected a $95.7 billion increase in the position in Europe, primarily in the United Kingdom and the Netherlands. By industry, manufacturing affiliates accounted for most of the increase.

The foreign direct investment in the United States position increased $331.2 billion to $4.46 trillion at the end of 2019 from $4.13 trillion at the end of 2018. The increase mainly reflected a $157.3 billion increase in the position from Asia and Pacific, primarily Japan. By industry, affiliates in manufacturing, finance and insurance, and wholesale trade accounted for the largest increases.

Other highlights from the direct investment statistics for 2019:

- Dividends, or repatriated earnings, by U.S. multinationals decreased $454.5 billion in 2019 to $396.3 billion from $850.9 billion in 2018, but were still more than twice the average dividends from the prior 10 years. By country, over half of the dividends were repatriated from Ireland, the Netherlands, and Bermuda. By industry, U.S. multinationals in chemical manufacturing and computer and electronic products manufacturing repatriated the most.

- The foreign direct investment in the United States position was concentrated in the U.S. manufacturing sector, which accounted for 40.1 percent of the position.

For more information, read the full report.