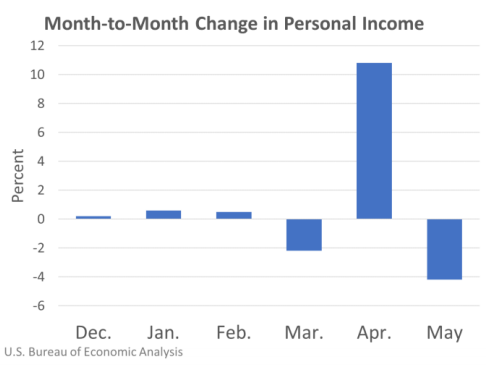

Personal Income

Personal income decreased 4.2 percent while consumer spending increased 8.2 percent in May, according to estimates released today by the Bureau of Economic Analysis.

The decrease in personal income in May primarily reflected a decrease in government social benefits. “Other” social benefits decreased as payments to individuals from federal economic recovery programs continued, but at a lower level than in April. For more information, see “How are the economic impact payments for individuals authorized by the CARES Act of 2020 recorded in the NIPAs?”. Additional information on factors affecting monthly personal income can be found on the Effects of Selected Federal Pandemic Response Programs on Personal Income table.

Partially offsetting the decrease in other government social benefits was an increase in unemployment insurance benefits, based primarily on unemployment claims data from the Department of Labor’s Employment and Training Administration. For more information, see “How will federal government responses to the COVID-19 pandemic affect unemployment insurance benefits?”.

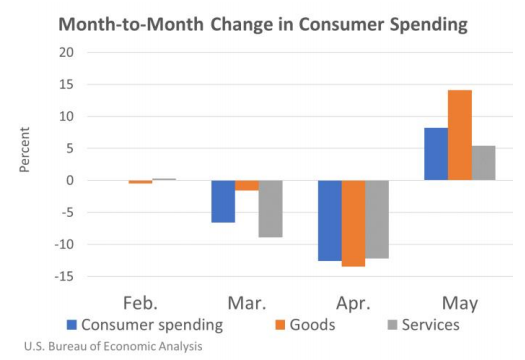

Consumer Spending

Consumer spending increased in May, reflecting increases in both goods and services.

- Within goods, the leading contributor to the increase was spending on new motor vehicles, especially new light trucks, based on unit sales from Ward’s Automotive Sales Reports. Spending on recreational goods and vehicles also increased, reflecting Census Bureau Monthly Retail Trade Survey (MRTS) data.

- Within services, the leading contributor to the increase was spending on health care, based primarily on employment, hours, and earnings data from the Bureau of Labor Statistics Current Employment Situation report as well as credit card data. Other contributors to the increase were spending on food services and accommodations, based on Census MRTS data and Smith Travel Research data.

For more information, read the full report.