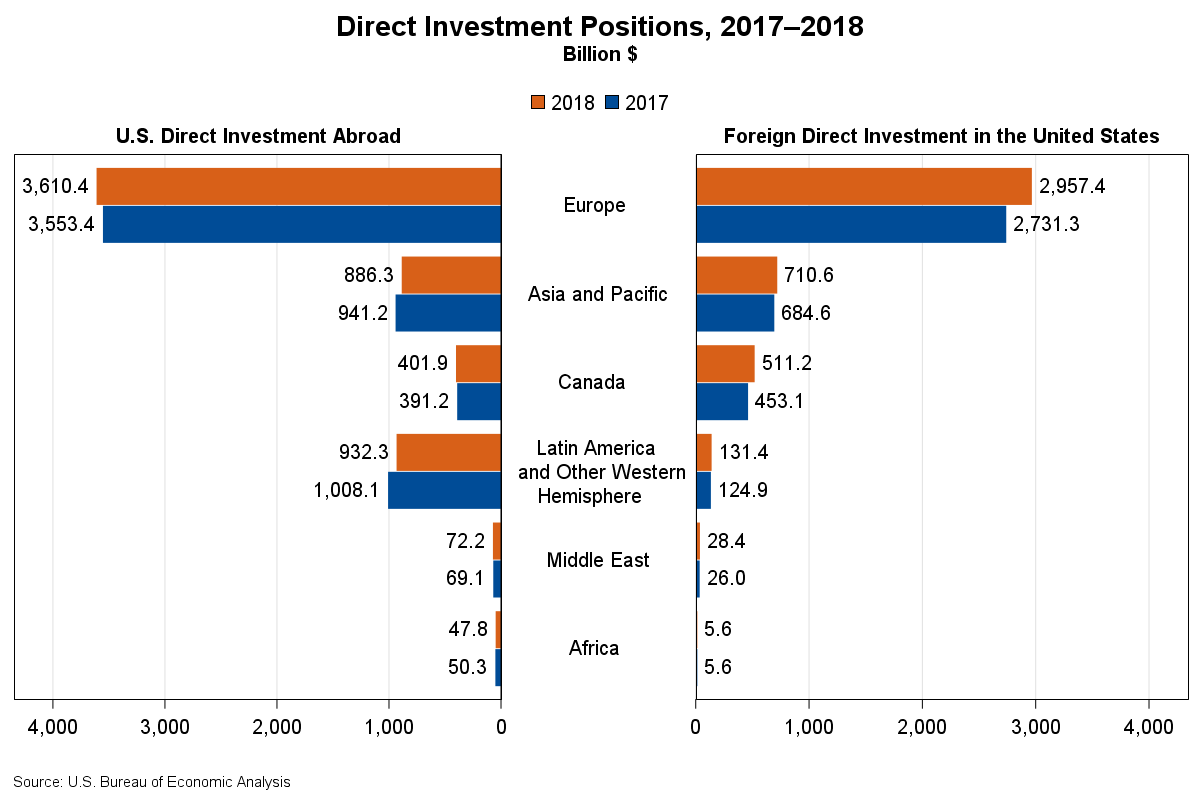

The U.S. direct investment abroad position, or cumulative level of investment, decreased $62.3 billion to $5.95 trillion at the end of 2018 from $6.01 trillion at the end of 2017. The decrease was due to the repatriation of accumulated prior earnings by U.S. multinationals from their foreign affiliates, largely in response to the 2017 Tax Cuts and Jobs Act. The decrease reflected a $75.8 billion decrease in the position in Latin America and Other Western Hemisphere, primarily in Bermuda. By industry, holding company affiliates owned by U.S. manufacturers accounted for most of the decrease.

The foreign direct investment in the United States position increased $319.1 billion to $4.34 trillion at the end of 2018 from $4.03 trillion at the end of 2017. The increase mainly reflected a $226.1 billion increase in the position from Europe, primarily the Netherlands and Ireland. By industry, affiliates in manufacturing, retail trade, and real estate accounted for the largest increases.

Other highlights from the direct investment statistics for 2018:

- The U.S. direct investment abroad position decreased for the first time since 1982 due to repatriations of $776.5 billion by U.S. multinationals. By country, nearly half of the repatriations were from Bermuda and the Netherlands. By industry, U.S. multinationals in chemical manufacturing and computer and electronic products manufacturing repatriated the most.

- The foreign direct investment in the United States position was concentrated in the U.S. manufacturing sector, which accounted for 40.8 percent of the position.

For more information, read the full report.