Real gross domestic product (GDP) increased 1.2 percent in the second quarter of 2016, according to the “advance” estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent (revised).

GDP highlights

The second‐quarter increase in real GDP was more than accounted for by an increase in consumer spending. Spending on both nondurable and durable goods increased, as did spending on services, notably on housing and utilities and on health care.

The increase in consumer spending was partly offset by a decline in inventory investment. In fact, GDP less inventory investment (real final sales of domestic product) increased 2.4 percent in the second quarter.

Also partly offsetting contributions to real GDP growth, business investment declined, reflecting declines in structures and in equipment, and housing investment decreased.

Personal income and saving

Real disposable personal income—personal income adjusted for taxes and inflation—increased 1.2 percent in the second quarter after increasing 2.2 percent in the first quarter. Personal saving as a percent of disposable personal income was 5.5 percent in the second quarter, compared with 6.1 percent in the first quarter.

Annual update

BEA also released its 2016 annual update of the national income and product accounts, which updated most components from the first quarter of 2013 to the first quarter of 2016 based on newly available and revised source data. From the fourth quarter of 2012 to the first quarter of 2016, real GDP increased at an annual average rate of 2.2 percent, the same as previously published. For more information, see the technical note.

First‐quarter prices

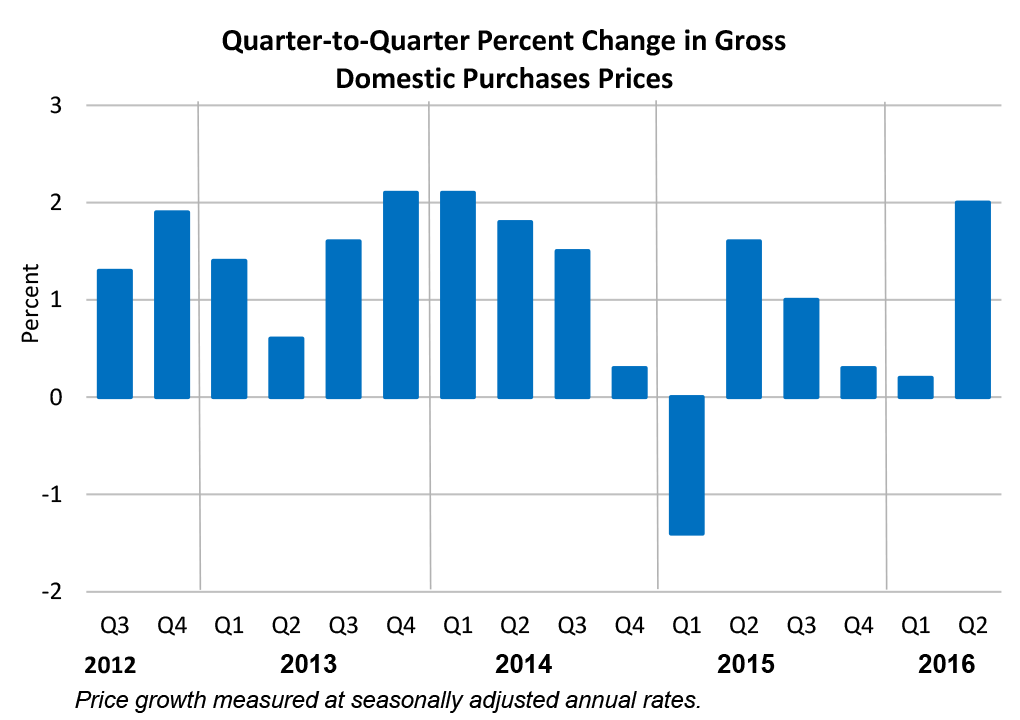

Prices of goods and services purchased by U.S. residents increased 2.0 percent in the second quarter of 2016, after increasing 0.2 percent in the first quarter.

Food prices decreased in the second quarter, while energy prices increased.

Excluding food and energy, prices increased 1.9 percent in the second quarter, compared with an increase of 1.4 percent in the first quarter.

For more information, read the full report.