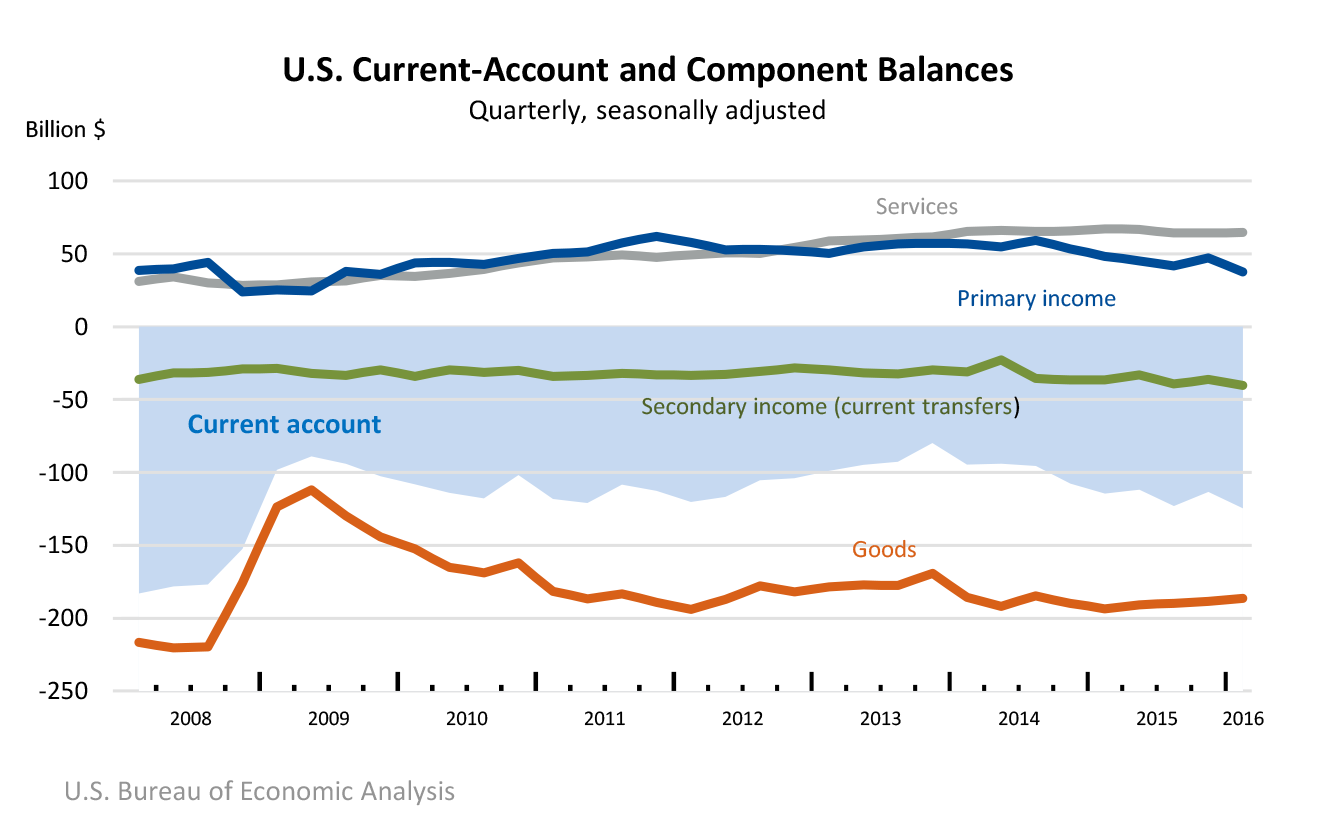

The U.S. current-account deficit—a net measure of transactions between the United States and the rest of the world in goods, services, primary income (investment income and compensation), and secondary income (current transfers)—increased to $124.7 billion (preliminary) in the first quarter of 2016 from $113.4 billion (revised) in the fourth quarter of 2015. As a percentage of U.S. GDP, the deficit increased to 2.7 percent from 2.5 percent. The previously published current-account deficit for the fourth quarter was $125.3 billion.

- The deficit on international trade in goods decreased to $186.4 billion from $188.4 billion as goods imports decreased more than goods exports.

- The surplus on international trade in services increased to $64.6 billion from $64.2 billion as services exports increased more than services imports.

- The surplus on primary income decreased to $37.5 billion from $47.1 billion as primary income payments increased more than primary income receipts.

- The deficit on secondary income (current transfers) increased to $40.3 billion from $36.3 billion as secondary income payments increased and secondary income receipts decreased.

Net U.S. borrowing from financial-account transactions was $35.0 billion in the first quarter, up from $21.8 billion in the fourth.

- Net U.S. acquisition of financial assets excluding financial derivatives was $66.8 billion in the first quarter, a shift from net sales of $152.5 billion in the fourth.

- Net U.S. incurrence of liabilities excluding financial derivatives was $115.5 billion in the first quarter, a shift from net repayment of $118.3 billion in the fourth.

- Net lending in financial derivatives other than reserves was $13.6 billion in the first quarter, up from $12.4 billion in the fourth.

For more information, read the full report.