News Release

Real Personal Consumption Expenditures by State and Real Personal Income by State and Metropolitan Area, 2021

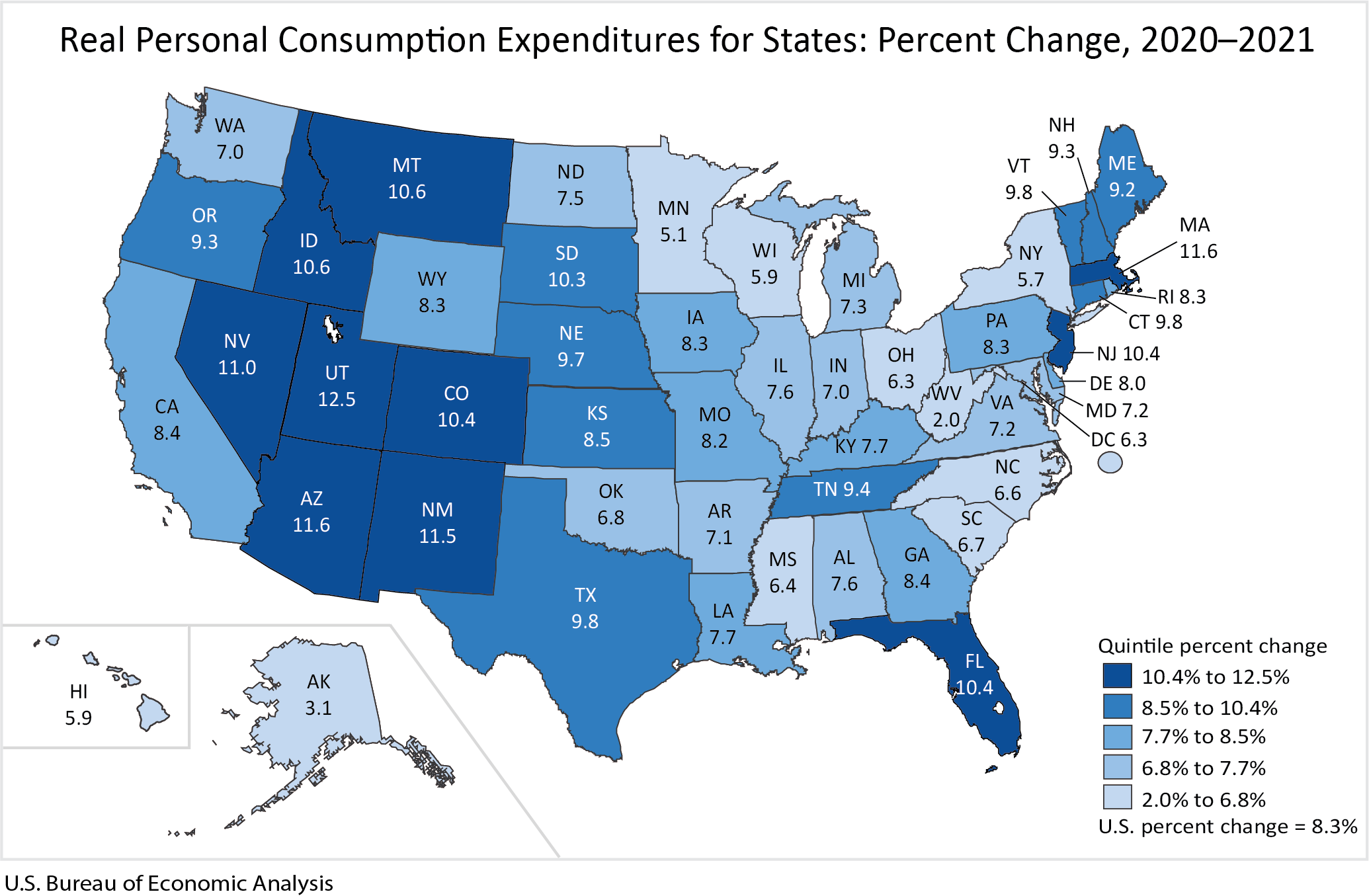

Real personal consumption expenditures (PCE) by state increased in all 50 states and the District of Columbia in 2021, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). The percent change in real PCE across all 50 states and the District of Columbia ranged from 12.5 percent in Utah to 2.0 percent in West Virginia (table 1).

Real PCE by state is a state's current-dollar PCE (Consumer Spending by State) adjusted by the state's regional price parity and the national PCE price index. In 2021, the national PCE price index increased 4.0 percent.

- Utah had the largest increase in real PCE, at 12.5 percent. Current-dollar PCE increased 16.3 percent while its implicit regional price deflator increased 3.4 percent (table 2).

- Massachusetts and Arizona had the second largest increase in real PCE, at 11.6 percent. Current-dollar PCE increased 13.4 percent and 13.1 percent in Massachusetts and Arizona, respectively. Their implicit regional price deflators increased 1.6 percent and 1.3 percent, respectively.

- West Virginia had the smallest increase in real PCE, at 2.0 percent. Current-dollar PCE increased 10.3 percent while its implicit regional price deflator increased 8.1 percent.

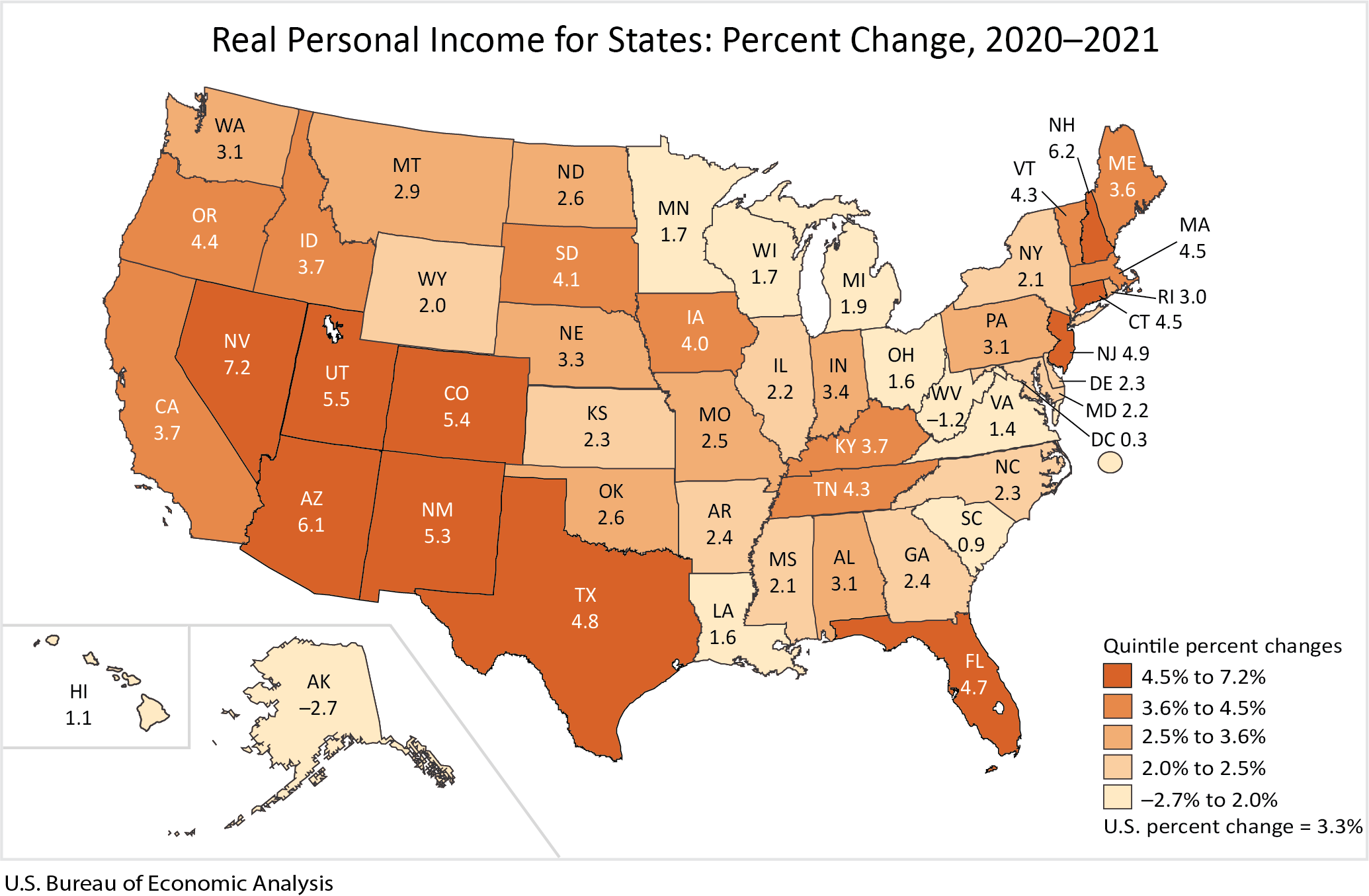

Real personal income

Real personal income increased in 48 states and the District of Columbia in 2021. The percent change in real personal income across all 50 states and the District of Columbia ranged from 7.2 percent in Nevada to –2.7 percent in Alaska (table 1).

- Nevada had the largest increase in real personal income, at 7.2 percent. Current-dollar personal income (Personal Income by State) increased 9.7 percent while its implicit regional price deflator increased 2.3 percent.

- Alaska had the largest decrease in real personal income, at 2.7 percent. Current-dollar personal income increased 4.9 percent while its implicit regional price deflator increased 7.8 percent.

- West Virginia was the only other state with a decrease in real personal income, at 1.2 percent. Current-dollar personal income increased 6.8 percent while its implicit regional price deflator increased 8.1 percent.

Regional price parities

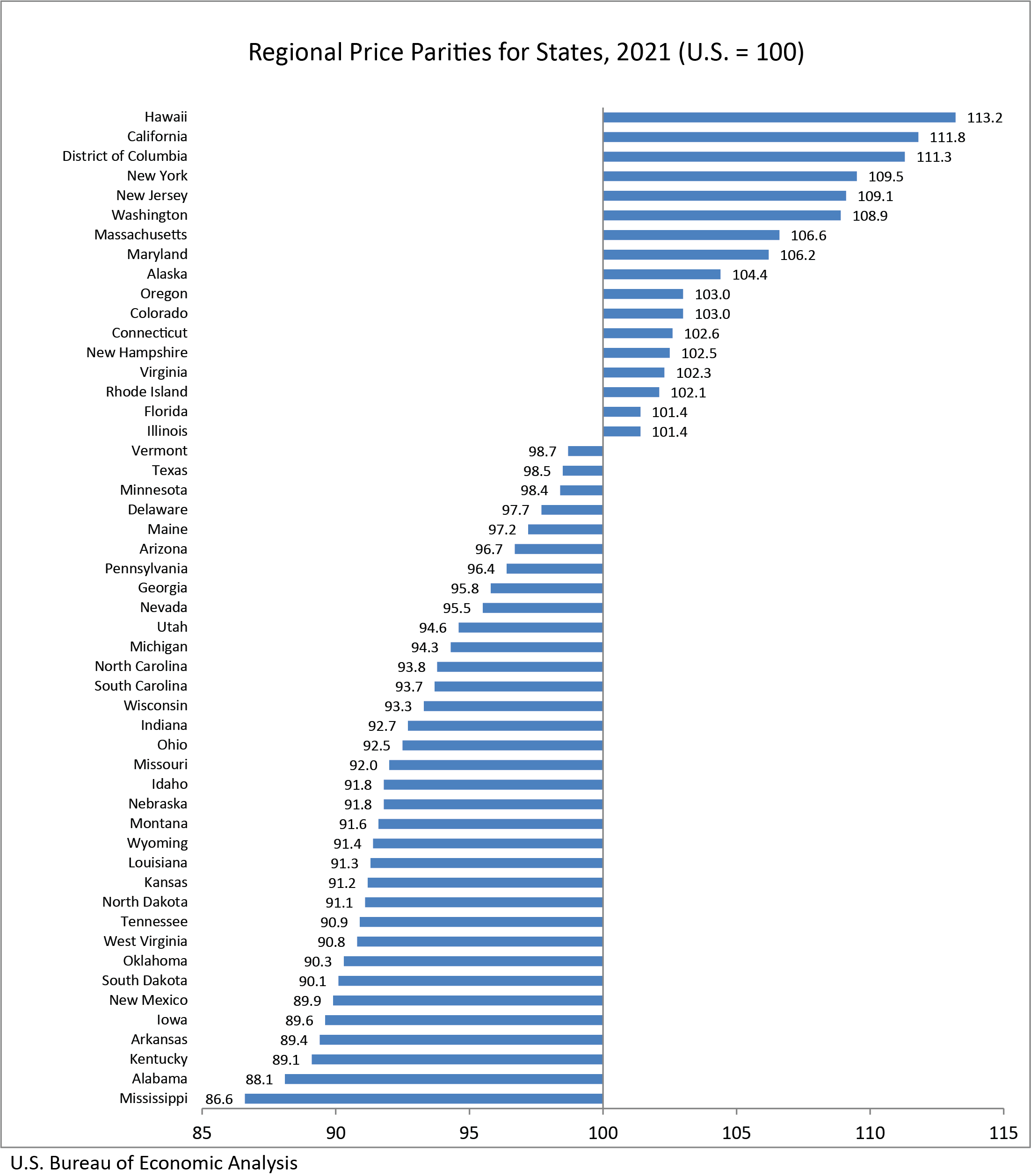

Regional price parities (RPPs) measure the differences in price levels across states for a given year and are expressed as a percentage of the overall national price level.

The all items RPP covers all consumption goods and services including housing rents. Areas with high/low RPPs typically correspond to areas with high/low price levels for rents.

- States with the highest RPPs were Hawaii, at 113.2, California, at 111.8, and New York, at 109.5; the RPP in the District of Columbia was 111.3 (table 2).

- States with the lowest RPPs were Mississippi, at 86.6, Alabama, at 88.1, and Kentucky, at 89.1.

- Across states, California had the highest RPP for housing rents, at 164.9, and Mississippi had the lowest, at 56.2; the RPP for housing rents in the District of Columbia was 175.4.

Annual update to regional real PCE and real personal income

The annual estimates of state real PCE for 2017 to 2020 and state and metropolitan area real personal income for 2014 to 2020 were revised. The updates incorporate revised source data that are more complete and more detailed than previously available. These include the results of the 2022 annual update of BEA's National and Regional Accounts.

BEA also released new estimates of state real per capita PCE statistics and real per capita personal income for 2021, along with revised estimates for 2010 to 2020. BEA used U.S. Census Bureau (Census) population figures to calculate per capita estimates for 2020 and 2021. For 2010 through 2019, BEA used intercensal population statistics that it developed based on Census methodology. See "Note on Per Capita Personal Income and Population."

Next release: December 14, 2023

Real Personal Consumption Expenditures by State and Real Personal Income by State and Metropolitan Area, 2022

Technical Notes on Regional Price Parities and Implicit Regional Price Deflators

Price indexes commonly measure price changes over time. The BEA PCE price index and the Bureau of Labor Statistics Consumer Price Index (CPI) are two examples. Spatial price indexes measure price level differences across regions for one period. An example of these types of indexes are purchasing power parities, which measure differences in price levels across countries for a given period and can be used to convert estimates of per capita gross domestic product into comparable levels in a common currency. The RPP that BEA has developed compares regions within the United States, without the need for currency conversion. An implicit regional price deflator (IRPD) can be derived by combining the RPPs and the U.S. PCE price index.

Regional price parities. The RPPs are calculated using price quotes for a wide array of items from the CPI covering apparel, education, food, housing, medical, recreation, transportation, and other goods and services.1 Data on housing rents are obtained separately from the Census American Community Survey (ACS). The expenditure weights for each category are constructed using BEA PCE and Census ACS housing rents expenditures.2

The CPI price levels and the ACS housing rents are combined with the expenditure weights using a multilateral aggregation method that expresses a region's price level relative to that of the United States.3

For example, if the RPP for area A is 120 and for area B is 90, then on average, price levels are 20 percent higher and 10 percent lower than the U.S. average for A and B, respectively. If the personal income for area A is $12,000 and for area B is $9,000, then RPP-adjusted incomes are $10,000 (or $12,000/1.20) and $10,000 (or $9,000/0.90), respectively. In other words, the purchasing power of the two incomes is equivalent when adjusted by their respective RPPs.

Implicit regional price deflator. The IRPD is a regional price index derived as the product of two terms: the RPP and the U.S. PCE price index.

The IRPD will equal current-dollar PCE divided by real PCE in constant dollars. The growth rate or year-to-year change in the IRPDs is a measure of regional inflation.4

For complete information on the data sources and estimating methods, see "Regional Price Parities, Real Personal Consumption Expenditures, and Real Personal Income."

1. The BEA RPP statistics are based in part on restricted access CPI data from the Bureau of Labor Statistics (BLS). The BEA statistics presented herein are products of BEA and not BLS.

2. To estimate RPPs, annual average CPI price quotes and ACS housing rents are quality adjusted. The rents data are from the ACS Public Use Microdata Sample, and results incorporate BEA's new method for estimating housing services across the regional and national accounts. For more information, see the May 2021 issue of the Survey of Current Business.

3. The multilateral system that is used is the Geary additive method. Any region or combination of regions may be used as the base or reference region without loss of consistency.

4. The growth rate of the IRPDs will not necessarily equal the region or metropolitan area price deflators published by BLS. This is because the CPI deflators are calculated directly, while the IRPDs are indirect estimates based on CPI and ACS price levels and PCE expenditure weights.