BEA added two questions to the BE-577 survey beginning in first quarter 2020 to collect information on the currency composition of intercompany debt receivable and payable balances between foreign affiliates and their U.S. parents. The U.S. dollar value of the debt denominated in euros, yen, and other currencies should be reported. Do not report the foreign currency value of the debt. The sum of the currency information should equal the total end of quarter balance reported in the previous question.

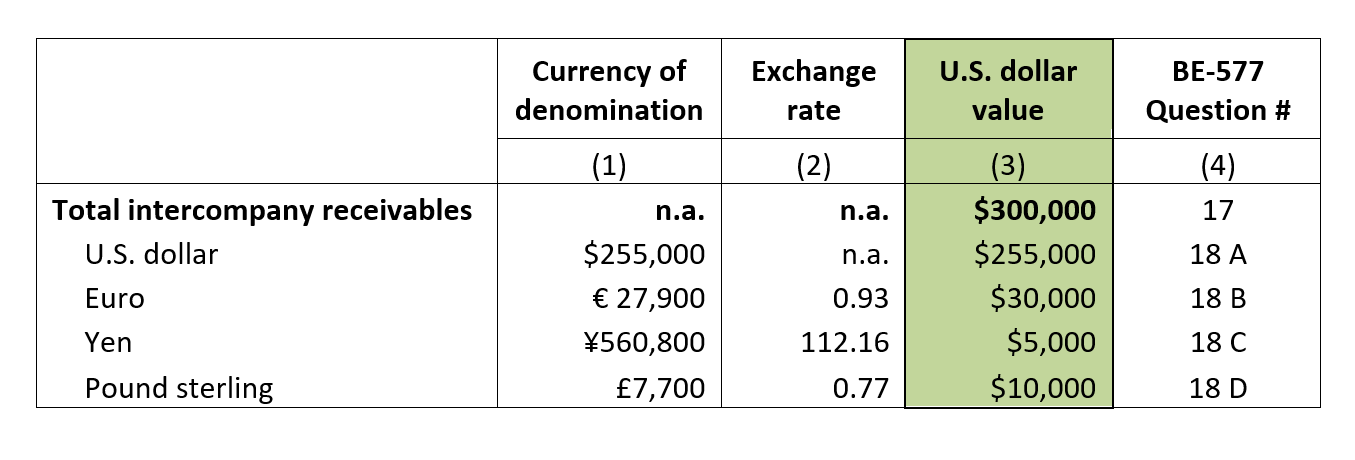

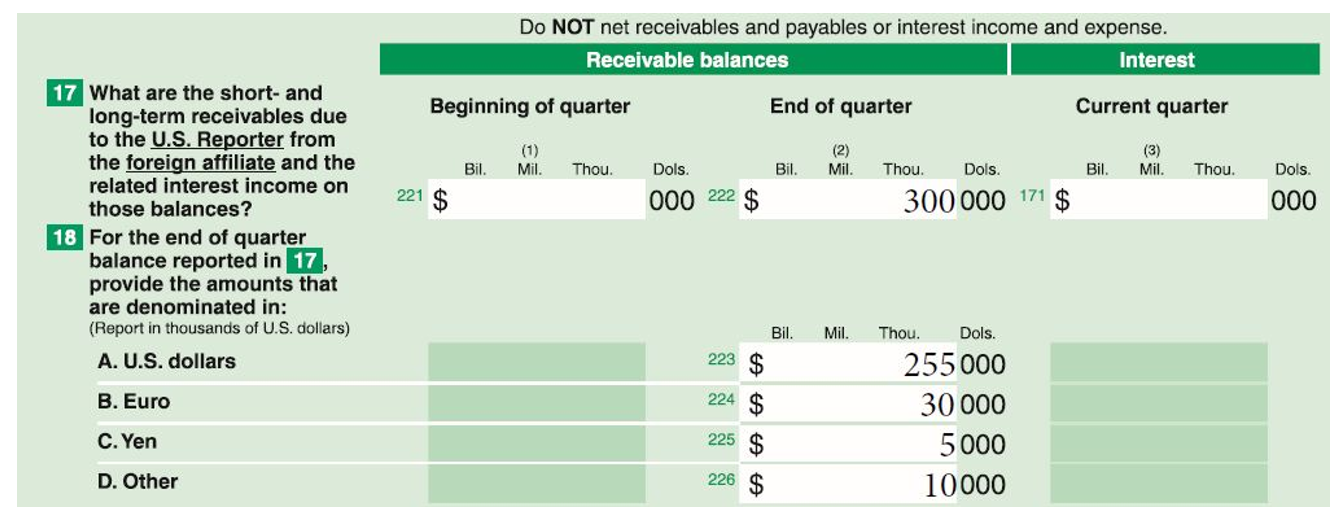

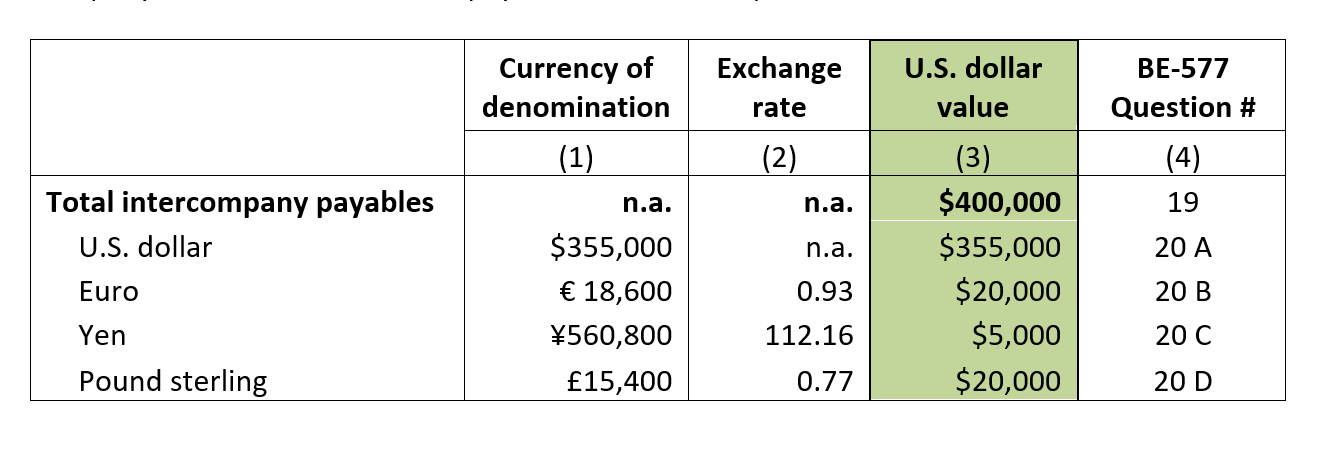

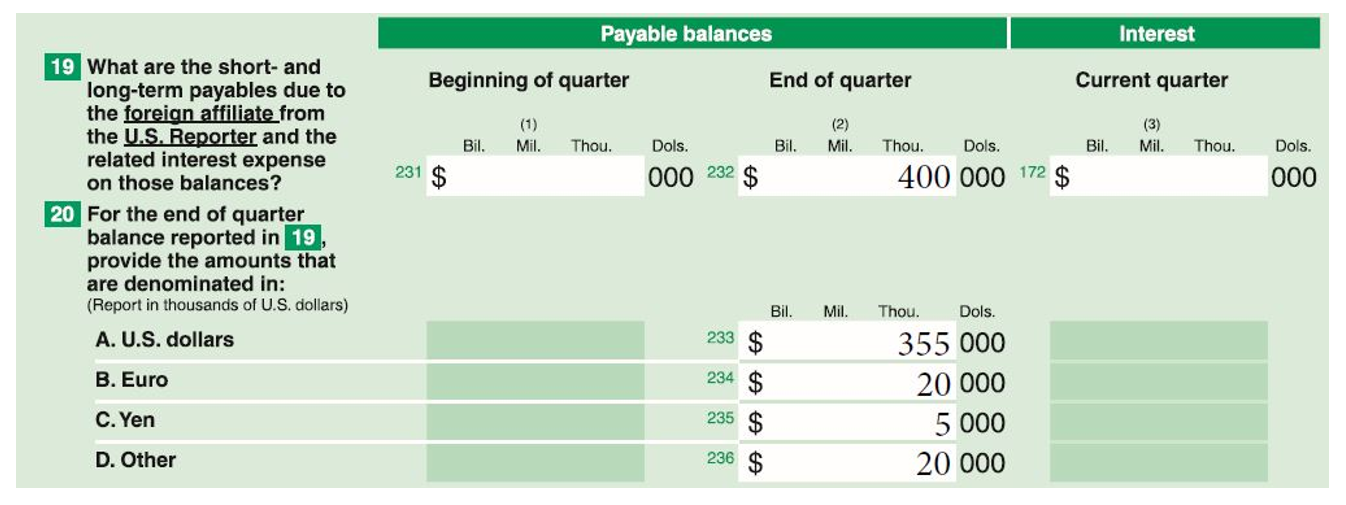

For example:

Company A has $300,000 in debt receivables with its U.S. parent denominated in four currencies:

Company A should report the values in column 3 to BEA. The total receivables should be reported as the end of quarter receivable balance in question 17 and the currency information should be reported in questions 18 A – D as shown in column 4 and below. Any receivables denominated in currencies other than U.S. dollar, euro, and yen should be summed together and reported in 18 D.

Company B has $400,000 in debt payables with its U.S. parent denominated in four currencies:

Company B should report the values in column 3 to BEA. The total payables should be reported as the end of quarter payable balance in question 19 and the currency information should be reported in questions 20 A – D as shown in column 4 and below. Any payables denominated in currencies other than U.S. dollar, euro, and yen should be summed together and reported in 20 D.

Please note that while BEA's surveys are mandatory and businesses are required by law to respond, the contents of these guidance documents do not have the force and effect of law and are not meant to bind the public in any way. These documents are intended only to provide clarity to the public regarding existing requirements under the law or Department policies.