BEA’s data on foreign direct investment in the United States (FDIUS) are classified by the country of the foreign owner. However, foreign multinational firms (MNCs) may own their U.S. affiliates through ownership chains that extend across multiple countries, so BEA has two ways of defining the owner:

- Foreign parent – BEA’s featured statistics of FDIUS position, income, and financial flows are classified by country of the foreign parent. As such the data are classified by the first country outside the United States with a direct claim on the U.S. affiliate.

- Ultimate beneficial owner (UBO) – BEA also provides FDIUS position and income statistics classified by country of the UBO – the entity that ultimately owns or controls the U.S. affiliate.

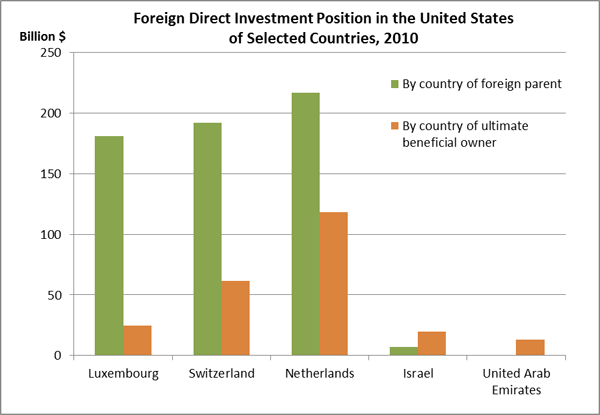

For most U.S. affiliates of foreign companies, the country of the UBO is also the country of the foreign parent. However, for some countries, the position classified by country of UBO can differ significantly from the position classified by country of foreign parent. Here are some examples (based on data for 2010):

- Luxembourg, Switzerland, and the Netherlands – These countries are financial centers through which MNCs based in other countries may channel their investments. Therefore, their direct investment positions in the United States are much higher by country of foreign parent than by country of UBO.

- Middle East – For several countries in the Middle East, position by country of foreign parent is lower than by country of UBO because investments from the Middle East are often routed through affiliates in other countries.

Published